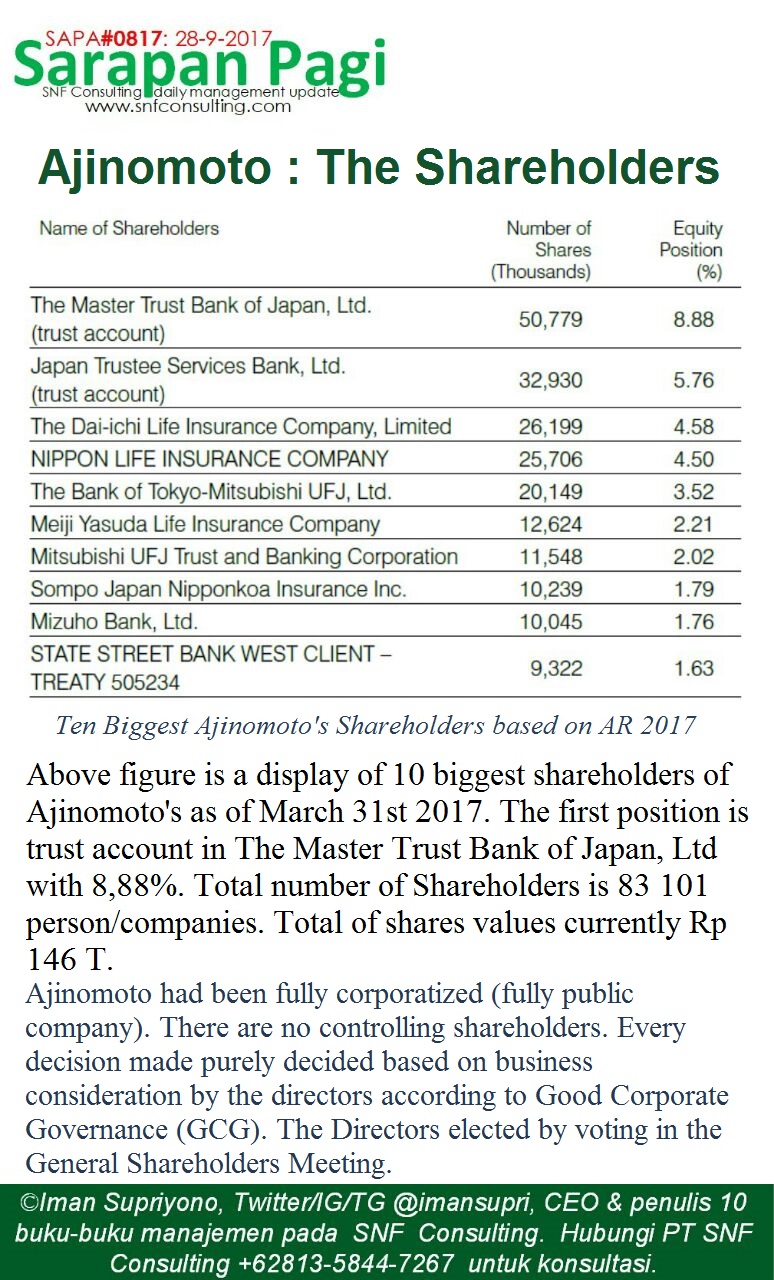

SAPA#0817 : Then why bother to set up and build a company if I finally no longer in control? This is a frequently asked question to oppose corporatization. The answer, maintaining control (stock> 50%) means limiting the entry of capital from new candidates. The company is curbed to only shop capital from a portion of its earnings. Growth is slow or even stagnant. Companies like this will lose to competing for human resources. Progressive young people will go to the competitor whose growth is aggressive. Consumers will be more enthusiastic to purchase in aggressive competitors. The company will be eliminated from the market. Conversely, corporate corruption will grow rapidly with additional capital contribution from new shareholders continuously. The management system is built. Able to capture the best talent. The market is welcome because the company has a crowding effect. Company value (market cap) doubled. Indeed the founder of the percentage of its shares will be small. It may not even go in the top 10 shareholders. But the value many times bigger. The dividend continues to flow steadily until the grandchildren to the great-grandchildren without seeing their career choices. As in Ajinomoto. Daily management update presented by SNF Consulting https://t.me/dailymanagementupdate