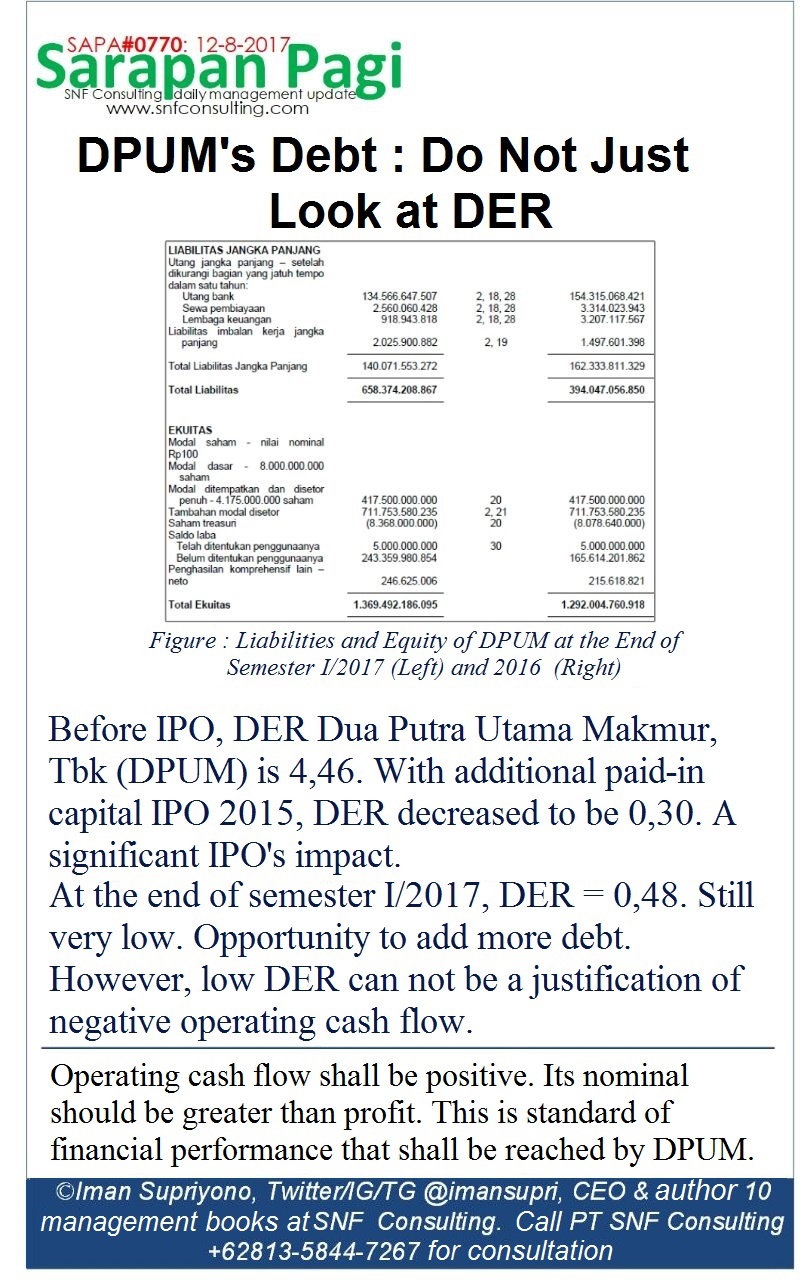

SAPA#0770: Debt to Equity Ratio (DER) reflects the firm’s management confidence to optimize capital that has been provided by the shareholders. Companies with zero DER means that the management only uses the paid up capital of a bank to run its business. The company’s expansions rely on non-distributed earnings as dividends. Company’s growth tend to be slow. It will be easily defeated in the market by massive expansion rivals through crowding effect. Thus, aggressive companies will find that low DER as an opportunity to increase debt and use it for expansion capital. This policy is good under condition the company’s positive operating cash flow above it’s profit. When cash flow is negative, low DER is not an opportunity to add debt for expansion. Just fix operational cash flow then go expansion with growing DER step by step. This is an urgent agenda for DPUM. Sarapan pagi presented by SNF Consulting.