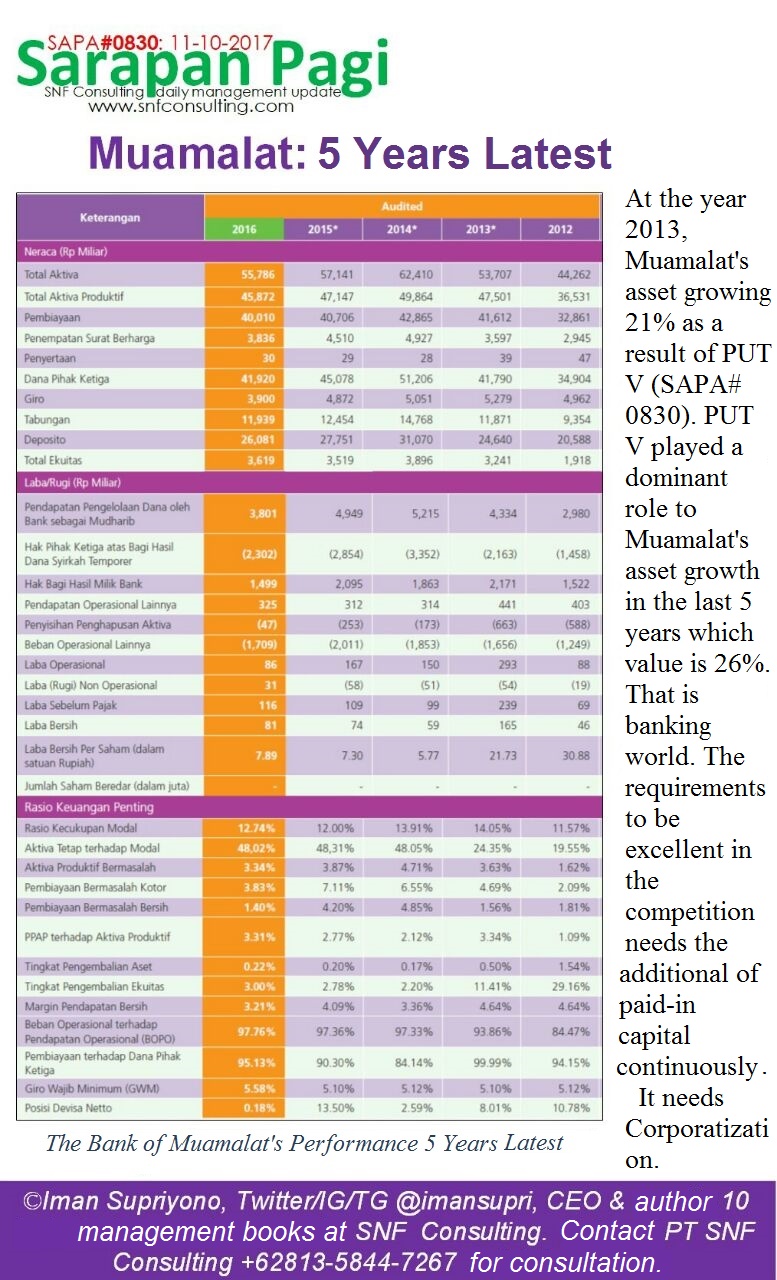

SAPA # 0830: “It’s nice to have a bank to spend money on your own business”. A statement we often hear. Many consider it to be true. Reality? To excel in the best market competition and human resource seizure, banks need to grow rapidly. The growth in question is in terms of assets, revenues, profits, and market capitalization. That growth will not happen without additional capital. Earnings alone are not enough. So shareholders are willing to accept no dividends. So they still have to increase the capital deposit or if it will not be diluted shares. With relatively good performance last 5 years, Muamalat’s shareholders decided not to pay dividends at all. Even volunteered to be diluted by its stake in PUT V if the shareholder has no funds to increase the capital deposit by executing Preemptive Rights (HMETD) to buy new shares. Is that enough? Not yet! The good bank is hungry for capital. This year the shareholders have decided that there will be PUT V with the greatest value in the history of Muamalat. Daily management update presented by SNF Consulting https://t.me/dailymanagementupdate

Standart Operational Procedur, Key Performance Indicator, Feasibility Study, Road Map, Class Management, Consultant Management, Consultant Business, Consultant Management Businesss, SNF Consulting