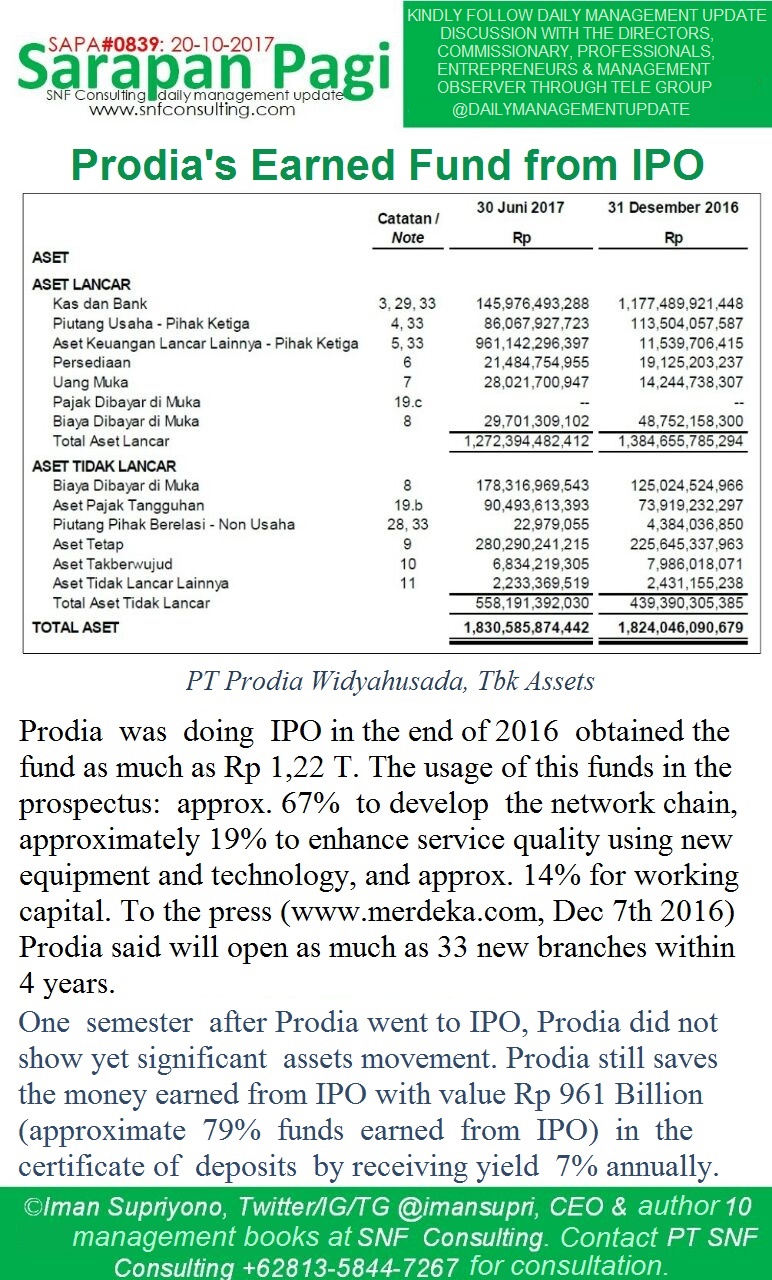

SAPA#0839 : For a high-vision company, the IPO is not the peak of achievement. IPO is not the finish line. Instead, the IPO is the starting line. IPO is the beginning of a process to utilize the core competence that is owned to meet the needs of society beyond the barriers of the state without any capital constraints. Starting from IPO, incoming funds, rising equity, DER down, IPO fund utilization according to prospectus, IPO fund expired, continuing market expansion by exploiting debt potential, DER back up, rights issue (release new shares) to re-raise equity and lower DER , utilizing right issue funds for expansion, right issue funds expiration continuing expansion by utilizing debt capacity, DER rose again and right issue again … So on … continue to grow bigger than the barriers of the country. How was the utilization of Prodia’s IPO fund late last year? It seems the management is still relaxed. Funds are still deposited in the bank as a deposit with a yield of 7% per year. There is no sign of Trap IPO because the funds have not been used yet. Prodia …. Come on…! Daily management update presented by SNF consulting

Standart Operational Procedur, Key Performance Indicator, Feasibility Study, Road Map, Consultant Business, Consultant Management, Consultant Management Business, Management Sparring Partner, SNF Consulting, Prodia’s Earned Fund From IPO